Blog Categories:

Your Tax Prep Checklist: 10 Things to Do Before the IRS Comes Knocking

Being your own boss sounds glamorous. You control your time, build your vision, and keep the profits. But behind the freedom lies a reality that often surprises new entrepreneurs. The truth is, there are hidden costs that can quietly eat away at your bottom line. The good news is you can spot these traps early and take steps to reduce them. Let’s look at the most common hidden costs of entrepreneurship and how to slash them before they derail your success.

Taxes are never fun, but for small business owners, being unprepared can turn them into a nightmare. Late filings, missing receipts, and disorganized books all make the IRS more interested in your business than you want them to be. That is why having a clear plan matters. Here is a practical small business tax preparation checklist to help you stay audit ready and stress free.

🔴 1️⃣ Gather All Income Records

The IRS wants to see every dollar that came into your business. Forgetting even small amounts can create big problems.

Checklist Table: Income Records

🟢 2️⃣ Collect Expense Documentation

Your deductions only count if you have proof. Keep receipts and digital copies organized.

Checklist Table: Expense Categories

🔵 3️⃣ Reconcile Bank and Credit Card Accounts

Make sure your bank statements match your bookkeeping. If they do not align, the IRS will ask why.

Checklist Table: Reconciliation Steps

🟣 4️⃣ Organize Payroll Records

If you pay employees or contractors, keep payroll reports, W2s, and 1099s in order.

Checklist Table: Payroll Records

🟡 5️⃣ Review Quarterly Estimated Tax Payments

Small businesses are expected to pay estimated taxes. Missing these can lead to penalties.

Checklist Table: Estimated Payments

🟠 6️⃣ Track Business Mileage

Mileage is one of the most commonly missed deductions. You need a clear log.

Checklist Table: Mileage Tracking

🔴 7️⃣ Review Asset Purchases and Depreciation

Large purchases like equipment or vehicles can be written off or depreciated.

Checklist Table: Asset Review

🟢 8️⃣ Double Check Tax Credits

Credits can save you thousands, but many small business owners miss them.

Checklist Table: Common Tax Credits

🔵 9️⃣ Prepare Your Financial Statements

Your P&L, balance sheet, and cash flow statement are the backbone of tax prep.

Checklist Table: Financial Reports

🟣 🔟 Schedule a Final Review with Your Accountant

Even if you prepare everything yourself, a professional review can save you from costly mistakes.

Checklist Table: Accountant Review Items

The Bottom Line

Tax season does not have to be a headache. By following this small business tax preparation checklist, you will reduce stress, avoid penalties, and be ready if the IRS ever comes knocking.

👉 Subscribe to Tea on the Ledger for more practical strategies and financial tips that help you stay audit proof and confident year round.

The Hidden Costs of Being Your Own Boss (And How to Slash Them)

Being your own boss sounds glamorous. You control your time, build your vision, and keep the profits. But behind the freedom lies a reality that often surprises new entrepreneurs. The truth is, there are hidden costs that can quietly eat away at your bottom line. The good news is you can spot these traps early and take steps to reduce them. Let’s look at the most common hidden costs of entrepreneurship and how to slash them before they derail your success.

Being your own boss sounds glamorous. You control your time, build your vision, and keep the profits. But behind the freedom lies a reality that often surprises new entrepreneurs. The truth is, there are hidden costs that can quietly eat away at your bottom line. The good news is you can spot these traps early and take steps to reduce them. Let’s look at the most common hidden costs of entrepreneurship and how to slash them before they derail your success.

1️⃣ Taxes You Did Not Plan For

When you are self employed, taxes are not taken out automatically. Forget to plan for them, and you could face a painful bill at year end.

Fix it: Open a separate savings account just for taxes and transfer a percentage of every payment you receive.

Dynamic Table: Suggested Tax Set Aside Rates

2️⃣ Health Insurance and Benefits

No employer means no benefits package. Health insurance, retirement contributions, and sick days all come out of your pocket.

Fix it: Shop around for a self employed health plan and build benefits into your pricing so you are not left short.

Dynamic Table: Monthly Benefit Costs to Expect

3️⃣ Tools and Technology Subscriptions

Software, apps, and platforms can add up quickly. That $29 subscription here and $15 there may seem small, but combined they drain cash every month.

Fix it: Audit your subscriptions quarterly and cancel tools you do not truly use.

Dynamic Table: How Small Subscriptions Add Up

4️⃣ Professional Services and Legal Fees

Lawyers, accountants, and consultants are vital, but their fees can surprise you.

Fix it: Budget for professional help in advance and shop around for flat fee services instead of paying high hourly rates.

Dynamic Table: Typical Annual Professional Costs

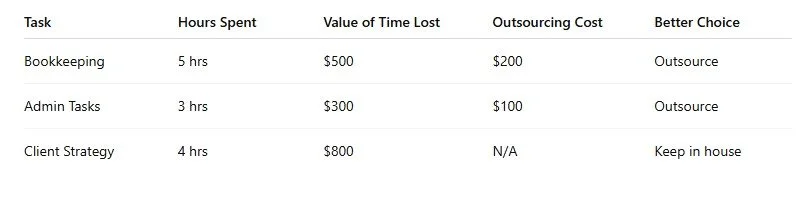

5️⃣ Opportunity Costs of Your Time

As your own boss, every hour has a price. Spending time on admin tasks or chasing late invoices is time you could have spent growing your business.

Fix it: Outsource low value tasks so you can focus on income generating work.

Dynamic Table: Time Value vs Outsourcing

The Bottom Line

The dream of being your own boss comes with hidden expenses that many do not expect. By planning for taxes, building in benefits, controlling subscriptions, budgeting for professional support, and protecting your time, you can keep more money in your pocket and grow smarter.

Managing these hidden costs of entrepreneurship will reduce stress, free up resources, and allow you to focus on building the business you love.

👉 Subscribe to Tea on the Ledger for more practical strategies and financial tips that help you master entrepreneurship.

How to Turn Your Side Hustle Into a 6-Figure Empire

Many people start a side hustle as a way to make a little extra cash. The idea of working for yourself, escaping the nine to five, and building something of your own is incredibly exciting. But how do you take your side hustle and scale it into a thriving six figure empire? The truth is, it is absolutely possible when you apply the right strategies. Today we will break down how to grow your side hustle to full time business step by step.

Many people start a side hustle as a way to make a little extra cash. The idea of working for yourself, escaping the nine to five, and building something of your own is incredibly exciting. But how do you take your side hustle and scale it into a thriving six figure empire? The truth is, it is absolutely possible when you apply the right strategies. Today we will break down how to grow your side hustle to full time business step by step.

🔴 1️⃣ Define Your Vision and Goals 🎯

A side hustle often begins casually, but to grow it into a real business you need clear goals. Ask yourself what success looks like. Do you want freedom, financial independence, or the chance to build a brand?

Table: Example Goals

🟢 2️⃣ Build a Strong Financial Foundation 💵

Your business cannot grow if the money side is messy. Get serious about separating personal and business accounts, track expenses, and reinvest profits back into your business.

Table: Sample Budget Split

🔵 3️⃣ Focus on Scalable Income Streams 📈

A side hustle often starts with trading time for money. To scale, you need to create income streams that do not depend on you working every hour. This could include digital products, online courses, memberships, or outsourcing parts of your service.

Table: Examples of Scalable Income

🟣 4️⃣ Build Your Brand and Audience 📢

A full time business cannot exist without customers who trust you. Build a strong brand identity, show up consistently online, and share content that educates, entertains, or inspires your target market.

Table: Brand Growth Checklist

🟡 5️⃣ Know When to Go Full Time 🚀

Leaving your job too early can create stress, but waiting too long can hold you back. The sweet spot is when your side hustle income covers your living expenses or when your growth potential is limited by your nine to five hours.

Table: Decision Checkpoint

The Bottom Line

Your side hustle is more than just a part time project. With clear goals, smart money management, scalable income streams, and a growing brand, you can confidently make the leap and grow your side hustle to full time business.

👉 Subscribe to Tea on the Ledger for more practical strategies and financial tips that help you turn your hustle into a thriving empire.

The 5-Second Trick to Better Cash Flow (It’s So Simple!)

Cash flow problems can sneak up on small business owners fast. You make sales, but money seems to vanish before bills are paid. The truth is that healthy cash flow does not just happen, it is built through intentional habits. One of the smartest cash flow hacks for small businesses is what I call The Five Sessions Trick. It is a simple, structured way to keep your finances in order without adding stress to your week.

Cash flow problems can sneak up on small business owners fast. You make sales, but money seems to vanish before bills are paid. The truth is that healthy cash flow does not just happen, it is built through intentional habits. One of the smartest cash flow hacks for small businesses is what I call The Five Sessions Trick. It is a simple, structured way to keep your finances in order without adding stress to your week.

🔴 1️⃣ Session One: Review Incoming Cash 💵

The first step is always knowing what is coming in. Check your invoices, sales receipts, and pending payments. Spot late payers early so you can follow up before it turns into a crisis.

Table: Tracking Incoming Cash

🟢 2️⃣ Session Two: Check Outgoing Cash 💸

Next, look at what is leaving your bank. Bills, subscriptions, payroll, and vendor payments can quietly drain your balance if you are not watching.

Table: Outgoing Cash Commitments

🔵 3️⃣ Session Three: Balance the Two ⚖️

Now compare incoming with outgoing. If your payments do not line up with expenses, you will see cash flow dips before they happen.

Table: Cash Flow Balance Example

🟣 4️⃣ Session Four: Build a Cushion 🏦

Set aside a portion of your income into a savings account for taxes, emergencies, or uneven months. Even a ten percent buffer can be a lifesaver when clients pay late.

Table: Simple Allocation Example

🟡 5️⃣ Session Five: Forecast Ahead 📊

Finally, map out your next four weeks. Anticipating shortfalls gives you time to line up credit, cut costs, or speed up collections.

Table: Cash Flow Forecast Example

The Bottom Line

The Five Sessions Trick is a small commitment with a huge payoff. By carving out just a few short check ins each week, you will prevent nasty surprises, make smarter decisions, and finally get control over your cash flow.

Following these cash flow hacks for small businesses is about working smarter, not harder.

👉 Subscribe to Tea on the Ledger for more practical strategies and financial tips that keep your business thriving.

Why Your Business Bank Account is Draining Your Cash (Fix This Now) (Copy)

Running your business is stressful enough without your bank quietly eating away at your profits. Hidden fees, missed opportunities, and poor banking habits can all drain your hard-earned cash before you even notice. The good news? With a few simple business banking tips for entrepreneurs, you can stop your bank from bleeding you dry and start keeping more money where it belongs: in your pocket.

Running your business is stressful enough without your bank quietly eating away at your profits. Hidden fees, missed opportunities, and poor banking habits can all drain your hard-earned cash before you even notice. The good news? With a few simple business banking tips for entrepreneurs, you can stop your bank from bleeding you dry and start keeping more money where it belongs: in your pocket.

🔴 1️⃣ Stop Paying Unnecessary Fees 💸

Many banks sneak in charges for overdrafts, wire transfers, or falling below a minimum balance. These little “gotchas” can add up to hundreds or even thousands each year.

Fix it: Compare business checking accounts regularly. Look for fee-free accounts or negotiate with your bank. Yes, you can actually ask them to waive fees.

Fee Comparison Table

🟢 2️⃣ Separate Personal and Business Funds 🔑

If you are still running expenses through your personal account, your records are probably a mess and tax season becomes a horror film.

Fix it: Always maintain a dedicated business bank account. It protects your legal liability, keeps your books clean, and impresses potential lenders or investors.

🔵 3️⃣ Use Tech Friendly Banks 📲

Old school banks often charge extra for features, while modern fintech banks provide integrations with QuickBooks, PayPal, or Stripe at no additional cost.

Fix it: Switch to a bank that connects with your bookkeeping and payment systems. This saves you time, reduces errors, and lets you see your cash flow in real time.

Feature Comparison Table

🟣 4️⃣ Keep an Eye on Your Cash Flow 🔍

Entrepreneurs often focus on sales but forget to track money moving in and out. Poor cash flow management can lead to overdrafts, emergency loans, or even missed payroll.

Fix it: Set weekly reminders to review your transactions. Many banks offer dashboards and alerts. Make use of them.

🟡 5️⃣ Build a Banking Relationship 🤝

Your bank is not just where you park money, it can also be a partner in growth. Banks with strong small business support can offer lines of credit, merchant services, or even networking opportunities.

Fix it: Do not treat your banker like a stranger. Schedule a quarterly check in to review your needs and goals.

🟠 6️⃣ Automate Savings for Taxes and Emergencies 🏦

One of the biggest mistakes entrepreneurs make is forgetting Uncle Sam and unexpected expenses.

Fix it: Open a second business savings account. Automate transfers of 10 to 20 percent of income to cover taxes and rainy days. You will thank yourself when deadlines and surprises hit.

Savings Allocation Table

The Bottom Line

Your business bank account should support your growth, not quietly siphon off your profits. By following these business banking tips for entrepreneurs, you will protect your cash flow, simplify your finances, and build a stronger foundation for scaling your business.

👉 Subscribe to Tea on the Ledger for more practical strategies and financial tips that keep your business thriving.

Are You Ready for an IRS Audit? (Spoiler: Probably Not)

Let’s get real for a second: no one, and I mean NO ONE, wakes up excited for an IRS audit. The phrase itself is enough to make even the most seasoned small business owner break out in a cold sweat.

But here’s the kicker: most audits don’t happen by accident. There are specific IRS audit triggers for small businesses that can land you in the hot seat.

So, let’s break down what those triggers are, how to avoid them, and how to keep the IRS from sending you a love letter you really, really don’t want.

Let’s get real for a second: no one, and I mean NO ONE, wakes up excited for an IRS audit. The phrase itself is enough to make even the most seasoned small business owner break out in a cold sweat.

But here’s the kicker: most audits don’t happen by accident. There are specific IRS audit triggers for small businesses that can land you in the hot seat.

So, let’s break down what those triggers are, how to avoid them, and how to keep the IRS from sending you a love letter you really, really don’t want.

🚩 The Top IRS Audit Triggers for Small Businesses

1️⃣ High Deductions Relative to Income

If your business claims big deductions but reports low income, the IRS starts raising eyebrows. For example, if you’re a freelance writer claiming $40,000 in deductions against $45,000 in income, that’s going to look fishy.

Tip: Keep receipts, document everything, and make sure your deductions are legit.

2️⃣ Home Office Deductions (Done Wrong)

Yes, you can deduct a home office - but only if it’s used exclusively and regularly for business. If your “home office” is actually the kitchen table you also use for dinner, taxes, and the occasional pizza night, the IRS might not be impressed.

Tip: Measure the square footage, take photos of your space, and don’t stretch the rules.

3️⃣ Big Jumps in Income or Expenses

A sudden spike in income or a dramatic increase in deductions can trigger a red flag. The IRS loves consistency, so when your numbers look wildly different from one year to the next, they might come knocking.

Tip: Be ready to explain. If your income doubled because you finally raised your rates (yay you!), have your records and documentation ready.

4️⃣ Cash-Heavy Businesses

Got a business where most transactions happen in cash - like restaurants, salons, or retail shops? The IRS knows cash is harder to track and more prone to, let’s say, creative accounting.

Tip: Report all income. The IRS has ways of estimating what you should be making based on your industry. Don’t get cute.

5️⃣ Filing Late or Not at All

If you’re consistently late with your filings, or worse, skipping them entirely - you’re asking for attention from the IRS. And not the good kind.

Tip: File on time. Set calendar reminders, hire a tax pro, do whatever it takes.

6️⃣ Claiming 100% Business Use for a Vehicle

The IRS knows that most small business owners don’t really use their car 100% for business (unless you’re a delivery driver or ride-share driver). Claiming the full deduction without solid records is a classic audit trigger.

Tip: Keep a mileage log. Be honest about how much of your driving is actually for business.

7️⃣ Excessive Meal and Entertainment Deductions

Yes, you can deduct business meals, but don’t try to write off every single latte and croissant you grab at the café. If your meal expenses are unusually high for your business type, the IRS will take notice.

Tip: Only deduct meals that are actually for business purposes, and keep a record of who you dined with and why.

😬 The Real Cost of an Audit

Even if you’re squeaky clean, an audit takes time, energy, and a ton of stress. If the IRS finds errors, you could face:

❌ Back taxes

❌ Penalties

❌ Interest

❌ A serious headache

The best defense? Stay prepared.

🧠 How to Audit-Proof Your Business

✅ Keep detailed records and receipts

✅ Track income and expenses accurately

✅ Don’t inflate deductions

✅ Be realistic with claims like home office and vehicle use

✅ File on time, every time

✅ Work with a tax pro or bookkeeper (hi there 👋)

🏁 Final Thoughts

Are you really ready for an IRS audit? Spoiler: probably not. But you can be if you take steps now to avoid the most common IRS audit triggers for small businesses.

Stay honest, stay organized, and stay ready - because the IRS doesn’t play around.

👉 Want more small business tax tips, finance hacks, and the occasional laugh to make it all a little less painful? Subscribe to Tea on the Ledger, your go-to for practical advice and a side of humor to keep your business running strong.

Let’s keep the IRS happy, and you out of the hot seat! 🌿

Freelancers: How to Survive Tax Season Without Losing Your Mind

Tax season. Two little words that can turn any freelancer into a ball of stress, armed with a pile of receipts, an empty coffee cup, and a sense of existential dread.

If you’re reading this, you’re probably already bracing yourself for the inevitable: the IRS wants their share, and it’s up to you to figure out how to make that happen - without losing your mind or your entire weekend.

But here’s the good news: with a little know-how (and a touch of humor), you can tackle tax season like a pro. Let’s break down the freelancer tax tips 2025 that’ll help you keep your sanity - and maybe even save a few bucks.

Tax season. Two little words that can turn any freelancer into a ball of stress, armed with a pile of receipts, an empty coffee cup, and a sense of existential dread.

If you’re reading this, you’re probably already bracing yourself for the inevitable: the IRS wants their share, and it’s up to you to figure out how to make that happen - without losing your entire weekend.

But here’s the good news: with a little know-how (and a touch of humor), you can tackle tax season like a pro. Let’s break down the freelancer tax tips 2025 that’ll help you keep your sanity, and maybe even save a few bucks.

💸 Tip #1: Set Aside 25–30% for Taxes (Like, Now)

The biggest mistake freelancers make? Spending every dollar they earn and then scrambling for tax payments.

Here’s the deal: taxes aren’t optional. The IRS expects you to pay, whether you’re ready or not. So, the golden rule? Every time you get paid, squirrel away 25–30% in a separate savings account, pretend it doesn’t exist.

When tax season rolls around, you’ll be so glad you did.

📅 Tip #2: Don’t Forget Quarterly Estimated Taxes

Freelancers don’t get taxes automatically withheld like traditional employees. That means you’re responsible for paying quarterly estimated taxes, and if you skip them - the IRS will send you a love letter (in the form of penalties).

Mark these 2025 due dates in your calendar:

✅ April 15

✅ June 15

✅ September 15

✅ January 15 (2026)

Pro tip: Automate reminders so you don’t accidentally ghost the IRS.

🧾 Tip #3: Track Every Deductible Expense

Think you’re too small to need expense tracking? Think again. Every dollar counts.

Here are just a few things you can write off as a freelancer:

✅ Home office expenses (rent, utilities, internet)

✅ Business software (QuickBooks, Canva, Zoom)

✅ Professional services (like your bookkeeper - hint, hint)

✅ Marketing costs (website, ads, branded pens you definitely needed)

✅ Continuing education (online courses, books)

✅ Health insurance (yes, that too!)

Bottom line: If it helps you run your freelance business, it’s probably deductible.

📊 Tip #4: Keep Good Records or Face the Chaos

No, your bank account isn’t your bookkeeping system. And no, you can’t “just wing it” until tax season…..unless you enjoy panic attacks and last-minute document hunting.

Get a system in place. Use accounting software like QuickBooks or Wave, or even a good old-fashioned spreadsheet. Just make sure you’re tracking income, expenses, and invoices all year long.

🧠 Tip #5: Know the Freelancer Tax Forms

Here’s a quick cheat sheet:

1099-NEC: What you’ll receive from clients who paid you $600 or more

Schedule C: Where you report your income and expenses

Schedule SE: Where you calculate your self-employment tax (yep, that’s 15.3%—brace yourself)

Form 1040: Your individual tax return

The good news? If you stay organized, these forms won’t seem so scary.

😂 Tip #6: Don’t Wait Until the Last Minute

Procrastinating on taxes is like waiting until the night before a big trip to pack, except instead of forgetting your toothbrush - you might forget a deduction and overpay the IRS.

Start early. Even if you’re not filing yet, get your paperwork together now. Your future self will thank you.

📢 Final Thoughts

Freelancers, tax season doesn’t have to be a nightmare. By following these freelancer tax tips for 2025, you can avoid the last-minute scramble, keep more of your hard-earned money, and maybe even enjoy a little peace of mind.

✅ Set aside money for taxes

✅ Pay estimated taxes on time

✅ Track every deductible expense

✅ Stay organized all year

✅ Start early (seriously, do it)

👉 Want more freelancer finance tips, tax strategies, and the occasional laugh to make it all a bit easier? Subscribe to Tea on the Ledger for practical advice, resources, and a little humor to help you thrive in business….without losing your mind.

Let’s tackle tax season together and come out on top! 🌿

The Tax Write-Offs You’re Probably Missing (and It’s Costing You Thousands!)

Tax season. That magical time of year when you realise just how many things you could have written off, if only you’d known.

If you’re a small business owner, chances are you’re missing out on some major tax savings. The IRS isn’t exactly throwing a parade to remind you about all the deductions you’re entitled to. That’s why we’re here: to break down the small business tax deductions for 2025 onwards that you can’t afford to overlook.

Let’s dive in, because leaving money on the table? Yeah, we don’t do that here.

Tax season. That magical time of year when you realise just how many things you could have written off, if only you’d known.

If you’re a small business owner, chances are you’re missing out on some major tax savings. The IRS isn’t exactly throwing a parade to remind you about all the deductions you’re entitled to. That’s why we’re here: to break down the small business tax deductions for 2025 onwards that you can’t afford to overlook.

Let’s dive in, because leaving money on the table? Yeah, we don’t do that here.

🧾 The Big (and Often Missed) Small Business Tax Deductions for 2025 onwards

1️⃣ Home Office Deduction

Yes, you can deduct part of your rent or mortgage, utilities, and even internet if you work from home, as long as you use the space exclusively for business. That means your kitchen table doesn’t count if you’re also using it for snack breaks and family dinners.

2️⃣ Business Meals

Grabbing lunch with a client? Hosting a coffee catch-up with a potential partner? Those meals are 50% deductible (and in some cases, 100% if provided at a company event). Just don’t go wild and try to write off every single Starbucks run, your accountant will give you the side-eye.

3️⃣ Professional Services

Bookkeepers, accountants (hello!), lawyers, consultants - those fees are all tax-deductible. If they help you run your business, they’re fair game.

4️⃣ Subscriptions and Software

Your Canva Pro account? Tax-deductible. Your QuickBooks subscription? Tax-deductible. That fancy SEO tool you only used once in January but keep paying for? Also tax-deductible (though maybe consider cancelling it).

5️⃣ Continuing Education

Courses, workshops, certifications, or even books that improve your business skills are deductible. Yes, that $199 online course counts - assuming you actually opened it (no judgment).

6️⃣ Marketing and Advertising

Your website hosting fees, business cards, Instagram ads, and even branded tote bags are all marketing expenses - and fully deductible. If it promotes your business, it’s a write-off.

7️⃣ Mileage and Car Expenses

If you drive for business purposes (think client meetings, supply runs, or networking events), you can deduct mileage. The 2025 IRS mileage rate hasn’t been confirmed yet, but it’s usually around 65 cents per mile. Track it—or risk losing it.

8️⃣ Business Insurance

Yep, that business liability insurance you grumble about paying every year? It’s deductible too.

9️⃣ Retirement Contributions

Contributing to a SEP IRA or Solo 401(k)? You can deduct those contributions, which is a win-win: save for the future and lower your tax bill today.

🔟 Bad Debts

If you’ve invoiced a client and they ghosted you (ugh), that bad debt may be deductible. Talk to your accountant, because even your heartbreak can save you some tax dollars.

😂 The Tax Deduction Myths You Need to Ignore

Let’s set the record straight:

❌ Your dog is not a business expense (even if he’s your “chief morale officer”)

❌ Your personal gym membership doesn’t count (unless you’re a fitness coach)

❌ That “networking” trip to Hawaii? Good luck convincing the IRS on that one

💸 How Much Could You Be Saving?

If you’re not taking advantage of these deductions, you could be missing out on thousands of dollars in tax savings every year.

Think about it:

Home office deduction? Could save you $1,500+

Mileage? Add another $2,000+

Professional services? Who knows how high that could go, depending on your team

It adds up fast.

🏁 Final Thoughts

Small business tax deductions in 2025 aren’t just about saving a few bucks, they’re about keeping your hard-earned money in your pocket, where it belongs.

✅ Keep your receipts

✅ Track your expenses (yes, all of them)

✅ Don’t assume you know what counts, ask a pro

✅ And please, for the love of spreadsheets, don’t wait until tax time to figure this out

👉 Want more smart business finance tips, practical advice, and a side of humor (because taxes are way less painful when you’re laughing)? Subscribe to Tea on the Ledger - where we make business finances less stressful, one blog at a time.

Let’s keep that tax bill low and your profits high! 🌿

Why Your Bookkeeping is a Ticking Time Bomb (And How to Defuse It)

Let’s face it - bookkeeping isn’t exactly the sexiest part of running a business. Most entrepreneurs don’t wake up thinking, Wow, I can’t wait to reconcile my bank statements today! But here’s the thing: ignoring your books is like ignoring a ticking time bomb under your desk.

One wrong move, and boom - your profits vanish, your tax bill explodes, and your business dreams go up in smoke.

So let’s talk about the bookkeeping mistakes that hurt profits, how they sneak up on you, and most importantly, how to defuse them before they blow up your business.

Let’s face it, bookkeeping isn’t exactly the sexiest part of running a business. Most entrepreneurs don’t wake up thinking, Wow, I can’t wait to reconcile my bank statements today! But here’s the thing: ignoring your books is like ignoring a ticking time bomb under your desk.

One wrong move, and boom…..your profits vanish, your tax bill explodes, and your business dreams go up in smoke.

So let’s talk about the bookkeeping mistakes that hurt profits, how they sneak up on you, and most importantly, how to defuse them before they blow up your business.

💥 The Most Common Bookkeeping Mistakes (aka Business Profit Killers)

1️⃣ Mixing Business and Personal Expenses

You know the drill: you’re at Target grabbing “office supplies,” but somehow there’s also a new candle, some snacks, and maybe a sweater in the cart. No judgment - but mixing business and personal finances is a recipe for chaos.

Why It Hurts Profits:

It makes tracking true business expenses a nightmare and can lead to missed deductions (aka, paying more tax than you need to).

Defuse It:

Open a separate business account. Swipe only that card for anything related to your business.

2️⃣ Ignoring Reconciliations

Reconciliations aren’t just for accountants - they’re how you make sure what’s in your bank account matches what’s in your books. Skip them, and you’re flying blind.

Why It Hurts Profits:

You’ll miss errors, duplicate charges, or sneaky subscription fees you forgot about.

Defuse It:

Reconcile your accounts monthly. Set a reminder if you must, just do it.

3️⃣ Not Tracking Accounts Receivable

Ah, unpaid invoices - the silent profit killer. If you’re not tracking who owes you money, chances are you’re leaving cash on the table.

Why It Hurts Profits:

You can’t spend money that’s still stuck in someone else’s pocket.

Defuse It:

Review your accounts receivable regularly. Follow up on unpaid invoices like your rent depends on it (because, let’s be honest, it does).

4️⃣ Misclassifying Expenses

Not everything is “Miscellaneous.” Putting expenses in the wrong categories can mess up your financial reports, cause confusion at tax time, and make it hard to see where your money is really going.

Why It Hurts Profits:

Bad data = bad decisions. Enough said.

Defuse It:

Learn your chart of accounts. Or better yet, hire a bookkeeper (hi there!).

5️⃣ Skipping Regular Financial Reviews

If you’re not looking at your financial reports regularly, you’re missing the full picture. It’s like driving with a blindfold on - fun for a movie plot, bad for business.

Why It Hurts Profits:

You’ll miss trends, overspending, or that subscription you forgot to cancel three months ago.

Defuse It:

Block out time every month to review your profit and loss, balance sheet, and cash flow. Pour yourself a coffee, make it a ritual.

🏁 The Bottom Line: Don’t Let Your Books Blow Up Your Business

Here’s the thing—bookkeeping mistakes that hurt profits aren’t just small errors. They add up, fast. One missed invoice, one misclassified expense, one unreviewed report… and suddenly your profits are leaking like a bad faucet.

But the good news? You can absolutely defuse the ticking time bomb by:

✅ Keeping business and personal finances separate

✅ Reconciling accounts monthly

✅ Tracking what you’re owed (and collecting it!)

✅ Categorizing expenses correctly

✅ Reviewing reports regularly

👉 Want more small business finance tips, bookkeeping hacks, and the occasional bad accounting pun? Subscribe to Tea on the Ledger - your go-to source for practical advice and a few laughs along the way.

Let’s turn that bookkeeping bomb into a profit powerhouse! 🌿

This One Tax Mistake Could Wreck Your Small Business (Don’t Let It!)

You started your business to follow your passion, make your own rules, and maybe sneak in a few “business lunches” (we see you). But there’s one thing that can tank your dreams faster than you can say tax deduction:

Common tax mistakes for small business owners.

And the biggest culprit of all? Poor recordkeeping.

Let’s break it down - what this tax mistake really costs you, the other tax pitfalls new business owners face, and how to steer clear of a financial disaster.

You started your business to follow your passion, make your own rules, and maybe sneak in a few “business lunches” (we see you). But there’s one thing that can tank your dreams faster than you can say tax deduction:

Common tax mistakes for small business owners.

And the biggest culprit of all? Poor recordkeeping.

Let’s break it down - what this tax mistake really costs you, the other tax pitfalls new business owners face, and how to steer clear of a financial disaster.

🚨 The #1 Tax Mistake: Poor Recordkeeping

It’s not flashy. It’s not fun. But bad recordkeeping is the silent assassin of small business success.

Here’s why:

You miss out on tax deductions

You risk misreporting income

You’re clueless when tax season hits (cue panic)

And you’re practically inviting an IRS audit with a bow on top

Poor recordkeeping is the #1 tax mistake small business owners make. Don’t let it be you.

📦 Other Common Tax Mistakes Small Business Owners Make

Let’s walk through the classic tax traps, so you can avoid them like a pro.

1️⃣ Mixing Personal and Business Finances

Buying groceries, office supplies, and your dog’s birthday cake on the same credit card? Yeah, no.

How to Fix It: Get a dedicated business bank account. Use it for everything related to your business.

2️⃣ Not Paying Estimated Taxes

Small business owners need to pay quarterly taxes. If you don’t, the IRS will hit you with penalties that hurt.

How to Fix It: Set aside 25–30% of income for taxes. Pay by April 15, June 15, September 15, and January 15.

3️⃣ Ignoring Sales Tax Requirements

Selling goods or services? You may need to collect and remit sales tax.

How to Fix It: Check your state’s rules. Some are chill; others are, well, less chill.

4️⃣ Missing 1099 Deadlines

If you pay a contractor more than $600, you must file a 1099-NEC by January 31.

How to Fix It: Track contractor payments all year. Don’t wait until January.

5️⃣ Not Hiring a Tax Pro

Think TurboTax will magically understand your business deductions? Spoiler: It won’t.

How to Fix It: Get a tax professional who knows small businesses and can help you save money legally.

😱 The Real Cost of Tax Mistakes

Let’s be blunt: tax mistakes can wreck your business.

Mess up your taxes, and you might:

❌ Owe back taxes and interest

❌ Get slapped with penalties

❌ Lose sleep (and sanity)

❌ Get audited (and no one wants that)

Ignoring taxes isn’t a savings strategy, it’s a fast track to financial stress.

✅ How to Stay Out of Tax Trouble

Here’s your small business tax survival checklist:

✅ Keep your records clean and organized

✅ Use bookkeeping software (QuickBooks, Wave, or a trusty spreadsheet)

✅ Pay your estimated taxes

✅ Separate business and personal accounts

✅ Work with a tax pro who gets small business life

The key is to be proactive, not reactive.

📢 Final Thoughts

Here’s the tea: Common tax mistakes for small business owners aren’t just minor slip-ups - they can derail your entire business if you’re not careful.

But the good news? They’re preventable.

✅ Keep your records tidy

✅ Know your tax deadlines

✅ Pay what you owe

✅ Ask for help when you need it

👉 Want more practical tips to help you keep your books and business on track? Subscribe to Tea on the Ledger for strategies, insights, and the occasional laugh - all straight to your inbox.

Let’s make sure tax season never ruins your week. 🌿

How Much Does Bookkeeping Really Cost? What No One Tells You

Let’s talk about the question every small business owner has Googled at 2 a.m.: How much does bookkeeping really cost?

Spoiler alert: it’s not a simple answer like “$99 a month.” And anyone who tells you it is? Probably trying to sell you a service that comes with more surprise fees than your last Uber ride.

So, let’s break it down - bookkeeping services pricing for small businesses, what you actually get for your money, and the hidden costs no one talks about. Grab your tea, and let’s spill it.

Let’s talk about the question every small business owner has Googled at 2 a.m.: How much does bookkeeping really cost?

Spoiler alert: it’s not a simple answer like “$99 a month.” And anyone who tells you it is? Probably trying to sell you a service that comes with more surprise fees than your last Uber ride.

So, let’s break it down - bookkeeping services pricing for small businesses, what you actually get for your money, and the hidden costs no one talks about. Grab your tea, and let’s spill it.

📊 What You’re Really Paying For

Here’s the thing: bookkeeping isn’t just about typing numbers into a spreadsheet. It’s about keeping your financial house in order so you can:

✅ Avoid tax-time panic attacks

✅ Make smart business decisions

✅ Spot problems before they become expensive disasters

When you pay for bookkeeping, you’re paying for:

Bank account and credit card reconciliations

Categorizing transactions (yes, even that one weird Amazon purchase)

Financial reports (P&L, Balance Sheet, the works)

Expense tracking

Tax-time prep (hello, 1099s!)

Sometimes, bonus budgeting help or cash flow forecasts

In other words, it’s not just “data entry”, it’s the foundation of your business finances.

💸 So… What Does Bookkeeping Cost?

Let’s talk numbers, because that’s what we’re here for:

💼 DIY Bookkeeping (aka You Doing Everything)

Cost: $0–$50/month (just the software, not your sanity)

Risk: High—because let’s be honest, you didn’t start a business to become an accountant, did you?

💻 Basic Bookkeeping Services

Cost: $200–$500/month

This usually covers reconciliations, basic reports, and transactions under a certain limit (think up to 100–200 a month).

📈 Full-Service Bookkeeping

Cost: $500–$1,500/month

Includes everything from basic services plus regular financial reviews, accounts payable/receivable management, and support for your growing business.

🌟 Custom Packages (for complex businesses)

Cost: $1,500+

For businesses with inventory, multiple locations, payroll, or international transactions - think restaurants, e-commerce, or agencies with a lot going on.

🤯 Hidden Costs Nobody Talks About

Here’s the tea they don’t spill on the sales page:

☕ “Additional Transaction” Fees – Some bookkeepers charge extra if you go over your monthly transaction limit.

☕ Clean-Up Fees – If your books are a hot mess (no judgment), there might be a one-time charge to get them tidy.

☕ Tax Prep Add-Ons – Not all bookkeepers handle tax filings, so you may need a separate CPA come tax time.

☕ Software Costs – QuickBooks isn’t always included, make sure to ask!

😂 The Real Cost of NOT Having a Bookkeeper

Let’s play a quick game of “What If”…

What if you don’t hire a bookkeeper and instead DIY your books?

Missed deductions? 🫣

Late tax payments? 😬

Messy reports that scare away lenders or investors? 😭

The real cost of not having a bookkeeper can be much higher than their monthly fee - just ask anyone who’s faced an IRS audit or had to hire an accountant for an emergency rescue mission.

🏁 Final Thoughts

Bookkeeping services pricing for small businesses isn’t a one-size-fits-all answer, but here’s what you need to know:

✅ Prices vary based on your business size and complexity

✅ You’re paying for peace of mind, not just number crunching

✅ A good bookkeeper is an investment, not an expense

✅ Cheaper isn’t always better - because fixing messy books? That’s expensive

👉 Want more no-fluff tips on how to manage your business finances without pulling your hair out? Subscribe to Tea on the Ledger for practical advice, smart strategies, and a little bookkeeping humor to keep you going.

Let’s make those numbers work for you, not against you! 🌿

Tax Deductions You’re Probably Missing in Your Business

When you’re starting or growing a business, you may find yourself reaching for your personal debit card more than you'd like to admit. But is using personal money for business expenses a smart move - or a slippery slope?

The answer depends on your goals, your legal setup, and how you manage the money trail.

In this post, we’ll explore the pros and cons of using personal funds to support your business, what it means for your taxes and legal protection, and how to do it the right way if you choose to go that route.

Let’s be honest - taxes are nobody’s favorite part of running a business. And if you’re a freelancer, consultant, or small business owner, there’s a good chance you’re leaving money on the table by not knowing what you can actually deduct.

That’s where these business finance tax deduction tips come in.

These aren’t the obvious ones (like office supplies or your accountant’s fee) - these are the sneaky, often-overlooked deductions that could save you thousands.

Let’s dive in.

💡 1. Home Office Deduction

Yep, your home workspace could be a goldmine for deductions. If you:

✅ Use part of your home exclusively for business

✅ And it’s your primary place of business

You can deduct a portion of:

Rent or mortgage interest

Utilities

Internet

Repairs

Pro tip: Use the simplified method if math isn’t your thing (it’s $5 per square foot, up to 300 square feet).

💡 2. Business Use of Your Car

If you use your car for business, even a little - you can deduct:

🚗 Mileage (65.5 cents per mile for 2023!)

🚗 Tolls and parking fees

🚗 Lease payments or depreciation (for owned vehicles)

But here’s the catch: You must track your miles - apps like MileIQ or QuickBooks Self-Employed make it easy.

💡 3. Professional Development

That course you took on marketing? The business finance workshop you attended? The industry conference in Vegas (yes, even that)?

✅ All tax-deductible.

You can write off:

Registration fees

Travel (flights, hotels, meals while traveling)

Educational books and materials

Investing in yourself = tax savings.

💡 4. Software & Subscriptions

Those monthly fees add up, but they’re deductible! Think:

💻 Canva

💻 QuickBooks

💻 Zoom

💻 Cloud storage (Google Drive, Dropbox)

💻 Scheduling tools (Calendly, Dubsado)

If you use it for your business, it’s a deduction.

💡 5. Health Insurance (for Self-Employed)

If you’re a solo business owner paying for your own health insurance, guess what?

✅ You can deduct 100% of your premiums (for yourself, your spouse, and dependents).

This is a biggie, don’t skip it!

💡 6. Retirement Contributions

Saving for your future can also save you money now.

Contributions to:

A Solo 401(k)

A SEP IRA

A SIMPLE IRA

are tax-deductible up to certain limits.

Plan ahead = less tax stress later.

💡 7. Phone & Internet

If you use your phone or internet for business (which, let’s be honest, who doesn’t?), you can deduct a portion of the bill.

Just make sure to:

✅ Keep records of usage

✅ Allocate a reasonable percentage (e.g., 50% if you split use with personal)

Final Thoughts

These business finance tax deduction tips can save you real money - but only if you use them!

Start small:

✅ Review your expenses

✅ Categorize what’s business vs. personal

✅ Track consistently

And when in doubt? Ask your accountant.

The Best Way to Organize Your Business Receipts

Let’s face it: tracking down business receipts during tax season is the WORST. You know you bought that printer ink, but where’s the proof? That client lunch? Buried somewhere in your inbox.

Organizing business receipts for taxes isn’t just about staying neat - it’s about saving money, avoiding headaches, and keeping the IRS happy.

The good news? You don’t need a fancy system or expensive software. Just a simple, consistent method that works for you.

Here’s exactly how to organize your business receipts like a pro, without spending hours on paperwork.

Let’s face it: tracking down business receipts during tax season is the WORST. You know you bought that printer ink, but where’s the proof? That client lunch? Buried somewhere in your inbox.

Organizing business receipts for taxes isn’t just about staying neat - it’s about saving money, avoiding headaches, and keeping the IRS happy.

The good news? You don’t need a fancy system or expensive software. Just a simple, consistent method that works for you.

Here’s exactly how to organize your business receipts like a pro, without spending hours on paperwork.

🚀 Why Organizing Business Receipts Matters

💡 Fun fact: The IRS requires businesses to keep proof of expenses. If you can’t show it, you risk losing out on deductions, or worse - facing an audit.

A good receipt system helps you:

✅ Maximize tax deductions

✅ Make bookkeeping easier

✅ Stay stress-free at tax time

✅ Prove your case if audited

So, let’s make it simple.

🗂️ Step 1: Choose Your System (Digital or Paper)

First, decide:

Digital receipts: Scan or save PDF copies

Paper receipts: Store them in folders, envelopes, or binders

📲 Pro Tip: Go digital whenever possible. Apps like QuickBooks, Dext, or Expensify make it easy to snap photos and auto-organize receipts.

📸 Step 2: Scan and Save Receipts Immediately

Don’t let receipts pile up. As soon as you get one:

Snap a picture

Upload it to your app, cloud folder (Google Drive, Dropbox), or bookkeeping software

Add a note: client name, expense type, and date

Even if you keep paper copies, back them up digitally for peace of mind.

🗃️ Step 3: Organize by Category

For tax season, sort receipts into categories that match your tax forms:

Office Supplies

Travel & Meals

Marketing

Equipment & Assets

Software & Subscriptions

Client Expenses

Miscellaneous

This makes it super easy to tally deductions later.

💸 Step 4: Keep Receipts for the Right Length of Time

For tax purposes, the IRS recommends:

3 years for most tax records

7 years if you claim a loss or deductions related to bad debt

So, make a habit of archiving old receipts once a year, but don’t toss them too soon!

🔒 Step 5: Secure Your Records

Back up your files in the cloud or on an external hard drive.

For physical receipts:

Use folders labeled by year and category

Keep them in a safe, dry place

Your future self (and your accountant) will thank you.

🏆 Bonus Tip: Create a Monthly Receipt Routine

Set a recurring calendar reminder:

10 minutes each week: Snap & file new receipts

30 minutes monthly: Review and categorize

Consistency = no chaos at tax time.

Final Thoughts

Organizing business receipts for taxes doesn’t have to be a chore. With the right system, and a little discipline, you’ll stay tax-ready, stress-free, and in control of your finances.

The Financial Checklist Every Freelancer Needs

Freelancing gives you freedom, but with that independence comes responsibility, especially when it comes to your finances. Whether you're a graphic designer, copywriter, or developer, staying on top of your money isn’t just smart - it’s essential for long-term success.

That’s why we created the ultimate Freelancer Business Finance Checklist to help you stay organized, compliant, and in control. No accounting degree required, just a commitment to financial clarity.

Freelancing gives you freedom, but with that independence comes responsibility, especially when it comes to your finances. Whether you're a graphic designer, copywriter, or developer, staying on top of your money isn’t just smart: it’s essential for long-term success.

That’s why we created the ultimate Freelancer Business Finance Checklist to help you stay organized, compliant, and in control. No accounting degree required - just a commitment to financial clarity.

✅ 1. Open a Dedicated Business Bank Account

One of the first financial moves every freelancer should make is separating personal and business finances. Mixing the two creates confusion and can raise red flags with the IRS.

Action Steps:

Open a business checking account

Use it exclusively for freelance income and expenses

Consider getting a business credit card for larger purchases

✅ 2. Set Up a Bookkeeping System

Good bookkeeping is the backbone of any successful freelance business. Whether you use software like QuickBooks, Wave, or a spreadsheet, consistency is key.

Your system should track:

Income (clients, platforms, referrals)

Expenses (software, supplies, education, etc.)

Mileage (if you drive for business purposes)

Invoices and payment status

✅ 3. Track Every Expense

Freelancers often miss out on valuable deductions simply because they don’t track their spending. A key part of any Freelancer Business Finance Checklist is capturing every legitimate expense.

Common deductible expenses include:

Home office costs (a portion of rent, utilities)

Internet and phone

Business meals and travel

Software subscriptions

Professional development

Use apps like Expensify, Bonsai, or QuickBooks Self-Employed to automate this.

✅ 4. Create and Send Invoices Promptly

Getting paid is priority #1, so your invoicing process should be smooth and timely.

Best practices:

Send invoices immediately after completing work

Include clear payment terms (net 7, net 15, etc.)

Use tools like FreshBooks or HoneyBook to automate invoices

Follow up on late payments with a firm, friendly reminder

✅ 5. Set Aside Money for Taxes

Unlike a traditional job, taxes aren’t withheld from your freelance income. That means it’s your job to prepare for quarterly payments and year-end filing.

Tax checklist items:

Set aside 25–30% of your income for federal and state taxes

Pay estimated quarterly taxes (April, June, September, January)

Track all deductible expenses to reduce taxable income

Consider hiring a tax professional

✅ 6. Save for Retirement

Freelancers don’t get employer 401(k)s, but that doesn’t mean you can’t save for the future. In fact, you have several options that come with tax benefits.

Retirement options for freelancers:

SEP IRA

Solo 401(k)

Traditional or Roth IRA

Even small, consistent contributions will add up - and help lower your taxable income.

✅ 7. Build a Cash Reserve

Freelance income can be unpredictable. A financial buffer will help you weather slow months or surprise expenses without panic.

Aim to save:

3–6 months of living and business expenses

Keep it in a high-yield savings account for easy access

✅ 8. Review Financials Monthly

Make it a habit to sit down once a month and review your finances. This is where you spot patterns, track growth, and identify areas to improve.

Monthly checklist:

Reconcile bank and credit card statements

Review income and expenses

Check outstanding invoices

Adjust budget or spending if needed

✅ 9. Prepare for Year-End and Taxes

Don’t wait until April to start thinking about taxes. Year-end prep should begin in December, or earlier if you’re planning ahead.

End-of-year to-do’s:

Collect 1099s from clients

Download bank and expense reports

Confirm all transactions are categorized

Schedule time with your CPA or tax pro

✅ 10. Keep Financial Documents Organized

Whether digital or paper, a well-organized system can save you hours of headaches during tax season or an audit.

Organize and store:

Receipts

Contracts

Tax documents

Bank and credit statements

Cloud-based storage like Google Drive or Dropbox makes this easy and secure.

Final Thoughts: Make Finances Your Freelance Superpower

Staying on top of your finances doesn’t have to be overwhelming. With this Freelancer Business Finance Checklist, you can bring order to the chaos, stay compliant, and build a sustainable freelance business that supports your goals: financial and otherwise.

Start with one section today and build momentum. The sooner you take control, the more freedom you’ll actually enjoy.

📌 Want to Know If Your Business Is Really Healthy?

At Breakspears Bookkeeping Services LLC, we help you:

✅ Track profit and cash flow side by side

✅ Get paid faster

✅ Build financial systems that support growth

👉 Explore our flat-rate bookkeeping packages

👉 Book a free discovery call to take control of your numbers—without the overwhelm.

How to Fix Messy Business Finances Before Tax Season

Let’s be honest - running a small business means wearing many hats. But when it comes to tax season, one hat no entrepreneur can afford to ignore is financial cleanup. If your books are a mess and receipts are scattered, you're not alone. The good news? Cleaning up small business finances for taxes is totally doable and can even save you money, stress, and time.

Here’s how to get your finances in order before the IRS/HMRC (or your accountant) comes knocking.

Let’s be honest - running a small business means wearing many hats. But when it comes to tax season, one hat no entrepreneur can afford to ignore is financial cleanup. If your books are a mess and receipts are scattered, you're not alone. The good news? Cleaning up small business finances for taxes is totally doable, and can even save you money, stress, and time.

Here’s how to get your finances in order before the IRS (or your accountant) comes knocking.

1. Start With a Financial Reality Check

Before diving into spreadsheets or software, pause and take stock. Ask yourself:

Are all your transactions recorded?

Have you been separating personal and business expenses?

Is your bank account reconciled?

Do you have a bookkeeping system in place?

Being honest about the state of your finances is the first step toward fixing them. Don’t worry if things aren’t perfect - clarity is better than chaos.

2. Categorize Income and Expenses Accurately

This might sound basic, but miscategorized expenses are one of the top reasons small business owners leave money on the table at tax time. Review each transaction and assign it the proper category:

Office supplies

Software subscriptions

Contractor payments

Meals and entertainment

Travel

Make sure you're consistent. Most tax software and CPAs rely on these categories to find deductions and ensure compliance.

Pro Tip: Use IRS Schedule C categories as a guide for consistency and simplicity.

3. Reconcile Your Accounts

Reconciling means matching your internal records with your bank and credit card statements. This ensures that no transactions are missed, duplicated, or mis-recorded. It’s a crucial step in cleaning up small business finances for taxes.

Look for:

Duplicate entries

Missing transactions

Incorrect amounts

Your bookkeeping software may offer reconciliation tools, but manual cross-checking is often necessary for accuracy.

4. Separate Personal and Business Finances

Still using one account for both personal and business expenses? Stop right now. Not only does this create a documentation nightmare, but it also raises red flags with auditors.

To clean things up:

Open a dedicated business checking account

Get a business credit card

Transfer any personal transactions out of your books

Going forward, keep all business activity within the business accounts. It’ll make next tax season infinitely easier.

5. Digitize and Organize Receipts

The IRS doesn’t require paper receipts, but you do need to prove expenses. If your receipts are living in your glovebox or crumpled in a drawer, now’s the time to digitize.

Use tools like:

Expensify

Shoeboxed

QuickBooks mobile app

Scan, categorize, and attach receipts to corresponding transactions. If you ever face an audit, this habit will pay off in a big way.

6. Review Payroll and Contractor Payments

Mishandling employee wages or contractor payments is a fast track to tax penalties. Double-check:

W-2s for employees

1099-NECs for contractors

Payroll tax withholdings and filings

Make sure all workers are properly classified, and all payments are documented. Misclassification is a common IRS audit trigger.

7. Consult a Professional (Yes, Really)

Even if you’re a DIY business owner, hiring a CPA or bookkeeper, especially before tax season, can help clean up your finances and spot deductions you didn’t even know existed.

Look for someone who:

Specializes in small business tax law

Uses cloud-based accounting software

Offers year-round support, not just during tax season

Think of it as an investment, not a cost.

8. Automate Moving Forward

Once you’ve cleaned up the mess, don’t let it happen again. Automate what you can:

Connect bank accounts to accounting software

Schedule recurring invoice reminders

Set up monthly reconciliations

Automate expense tracking with apps

Cleaning up small business finances for taxes is hard enough once, you don’t want to do it again next year.

Final Thoughts: A Clean Slate = A Clear Mind

Tax season doesn’t have to be a panic-inducing ordeal. By cleaning up your small business finances ahead of time, you gain more than just compliance - you gain peace of mind, potential savings, and a stronger handle on your business health.

Start today. Future you (and your accountant) will thank you.

💬 Think of it this way: Profit is a theory, cash is reality.

📌 Want to Know If Your Business Is Really Healthy?

At Breakspears Bookkeeping Services LLC, we help you:

✅ Track profit and cash flow side by side

✅ Get paid faster

✅ Build financial systems that support growth

👉 Explore our flat-rate bookkeeping packages

👉 Book a free discovery call to take control of your numbers—without the overwhelm.

Are You Overpaying? The Real Cost of Managing Business Finances

Let’s be honest: running a small business comes with a lot of hidden costs.

But one area that sneaks up on a lot of entrepreneurs? Managing your business finances.

Whether you're DIY-ing your bookkeeping, hiring a professional, or just winging it with a spreadsheet and crossed fingers, there’s a cost. And if you're not tracking that cost properly, you might be paying more than you think (in money and time).

So let’s break it down. Here's what goes into the cost of managing small business finances….and how to make sure you're getting the best return on every dollar you spend.

Let’s be honest: running a small business comes with a lot of hidden costs.

But one area that sneaks up on a lot of entrepreneurs? Managing your business finances.

Whether you're DIY-ing your bookkeeping, hiring a professional, or just winging it with a spreadsheet and crossed fingers, there’s a cost. And if you're not tracking that cost properly, you might be paying more than you think (in money and time).

So let’s break it down. Here's what goes into the cost of managing small business finances….and how to make sure you're getting the best return on every dollar you spend.

💼 The Three Ways to Manage Small Business Finances

There are generally three main approaches small business owners take when it comes to handling their money:

1. DIY (Do-It-Yourself)

You manage everything yourself: tracking income, expenses, taxes, and reporting.

2. In-House or Contracted Staff

You hire an in-house bookkeeper, accountant, or VA with financial experience.

3. Outsourced Bookkeeping Services

You partner with a remote bookkeeping service (like Breakspears Bookkeeping Services LLC) that handles everything for a monthly flat fee.

Let’s break down the real costs of each.

🧾 Option 1: The DIY Approach

💰 Direct Costs:

QuickBooks, Xero, or Wave subscription: $0–$90/month

Receipt scanning apps or mileage trackers: $10–$30/month

Your time: priceless… but not really

Let’s say you spend:

1 hour/week categorizing transactions

2 hours/month invoicing + chasing payments

2 hours/month preparing for taxes

That’s 6 hours/month x your hourly rate.

If your time is worth $75/hour, that’s $450/month in hidden costs - not including stress or mistakes.

⚠️ Common Risks:

Misclassified expenses = missed deductions

Late invoicing = delayed cash flow

Tax prep panic = missed deadlines or penalties

You’re flying blind with no accurate monthly reports

💡 DIY can be cost-effective at the beginning - but it’s not sustainable long-term if you want to grow.

🧍♀️ Option 2: Hiring In-House or Freelancers

💰 Costs:

In-house bookkeeper: $3,500–$5,500/month (salary + benefits)

Freelance bookkeeper or accountant: $40–$100/hour

Software still needed: $30–$90/month

✅ Pros:

High-touch support

Can work alongside you daily

Customizable tasks and hours

❌ Cons:

More expensive than outsourced options

Management overhead (training, oversight)

May still need a CPA for taxes

💡 This is ideal for larger or high-volume businesses, but overkill for many freelancers and solo business owners.

📦 Option 3: Outsourced Bookkeeping Services (Flat-Fee)

Outsourcing your bookkeeping to a remote service (🙋♀️ like ours) gives you:

Professional support

Transparent monthly costs

Software setup and integration

Monthly reports and cash flow clarity

💰 Typical Flat Fee Range:

$250–$500/month depending on transaction volume and services

Often includes: reconciliation, categorization, reporting, light advisory

✅ Pros:

You save 10–15+ hours/month

No payroll costs or contracts

No tax-time scramble

You gain clarity, consistency, and peace of mind

💡 At Breakspears Bookkeeping Services LLC, our clients tell us the cost is a fraction of what they were losing in time, mistakes, and missed opportunities.

🧠 What You Really Pay for When You Manage Finances Poorly

If you're doing it yourself, or not doing it at all - you're probably paying more than you realize. The real costs of poor financial management include:

Overpaying taxes (missed write-offs)

Late fees or penalties

Stress and burnout

Unpaid invoices

Missed growth opportunities (because you didn’t know what you could afford)

The truth is: you either pay to stay organized—or pay to clean up the mess later.

📈 How to Make Financial Management Affordable and Effective

To get the best value out of what you spend, follow this checklist:

✅ Use bookkeeping software (QuickBooks, Wave, or Xero)

✅ Separate business and personal accounts

✅ Set aside 20–30% for taxes monthly

✅ Run monthly reports (P&L, cash flow)

✅ Know when to delegate

✅ Choose a support system (DIY, hire, or outsource) based on your stage of business

💡 If you’re spending 5+ hours/month on your books, it may be time to outsource.

💬 Final Thoughts: Pay Less by Managing Smarter

You don’t have to overspend to get help. You just need to understand the true cost of managing small business finances - and make choices that align with your time, growth goals, and peace of mind.

At Breakspears Bookkeeping Services LLC, we offer affordable, remote bookkeeping services for freelancers and small business owners who are ready to ditch the chaos and finally feel in control of their numbers.

📌 Want to Know If You’re Overpaying?

Let’s run the numbers. We’ll show you exactly how much time and money you could save with a flat-fee monthly package.

👉 Explore our services or book a free discovery call today.

Top Financial Tools Entrepreneurs Swear By in 2025

Running a small business in 2025 means wearing a lot of hats, and if you’re like most entrepreneurs, the finance hat often feels the heaviest.

From tracking expenses to getting paid faster to staying tax-ready year-round, the right tools can save you hours of stress and thousands of dollars. But with so many apps and platforms out there, how do you know which ones are actually worth your time?

We’ve done the digging for you. Here are the best financial software tools for small businesses in 2025 the ones real entrepreneurs (and bookkeepers like us) swear by to keep their money under control and their sanity intact.

Running a small business in 2025 means wearing a lot of hats, and if you’re like most entrepreneurs, the finance hat often feels the heaviest.

From tracking expenses to getting paid faster to staying tax-ready year-round, the right tools can save you hours of stress and thousands of dollars. But with so many apps and platforms out there, how do you know which ones are actually worth your time?

We’ve done the digging for you. Here are the best financial software tools for small businesses in 2025 the ones real entrepreneurs (and bookkeepers like us) swear by to keep their money under control and their sanity intact.

💻 1. QuickBooks Online (Best All-In-One Accounting Software)

QuickBooks continues to lead the pack, and for good reason. It’s robust, reliable, and built for businesses of all sizes.

✅ Why entrepreneurs love it:

Automatic bank feeds and transaction categorization

Customizable invoicing

Real-time profit & loss and cash flow reports

Seamless integration with tools like Stripe, PayPal, and Gusto

💡 At Breakspears Bookkeeping Services, LLC, we specialize in QuickBooks Online and help our clients understand their numbers without the jargon.

📲 2. Relay (Best Banking Platform for Cash Flow Control)

Relay isn’t just a business bank, it’s a cash flow management tool in disguise.

✅ Why entrepreneurs swear by it:

Multiple checking accounts for budgeting and expense tracking

Easy-to-use dashboard for cash flow visibility

Works beautifully with QuickBooks Online

💡 Relay makes it easy to follow Profit First or bucket-style budgeting: ideal for solopreneurs and creative business owners.

💳 3. Melio (Best for Paying Vendors & Bills for Free)

Melio lets you pay bills using a credit card, even if your vendors only take checks or ACH.

✅ Why it stands out:

Schedule payments in advance (great for cash flow planning)

No subscription fee

Easily syncs with QBO

💡 Perfect for side hustlers and service-based businesses looking to extend cash availability.

📈 4. Xero (Great Alternative to QuickBooks)

If you’re not into QBO’s pricing model or interface, Xero is a powerful, clean alternative.

✅ Loved for:

Beautiful UX

Robust integrations

Strong mobile features

Affordable monthly pricing

💡 Used more commonly outside the U.S., but gaining traction among startups and consultants.

💼 5. Wave (Best Free Accounting Software for Solo Entrepreneurs)

If you’re just starting out or running a side hustle, Wave is a fantastic, no-cost option.

✅ Why it’s great:

Completely free for accounting, invoicing, and receipt scanning

Simple and intuitive

Ideal for businesses with basic needs

💡 Keep in mind: it lacks some advanced features like robust reporting and scalability.

📊 6. Float (Best for Cash Flow Forecasting)

Float is a forecasting tool that syncs with your accounting software and gives visual insights into your future cash flow.

✅ What makes it stand out:

Projects income and expenses over time

Helps you see how decisions will impact your financial future

Customizable scenario planning

💡 Perfect for seasonal businesses or anyone looking to plan ahead confidently.

👥 7. Gusto (Best for Payroll & Contractor Payments)

Hiring help? Gusto makes paying team members and contractors easy and compliant.

✅ Why it’s a must-have:

Automated payroll and tax filings

Onboarding and benefits integration

Contractor payment tracking and 1099 generation

💡 Combines seamlessly with QBO and Xero for a smooth payroll-to-bookkeeping workflow.

🧾 8. Dext (Best for Receipt Management and Bookkeeping Support)

Tired of stuffing receipts in a shoebox? Dext lets you upload, scan, and auto-categorize receipts and bills—effortlessly.

✅ Why business owners use it:

Snap receipts on your phone, upload to your books

OCR reads and fills in data

Saves hours of manual entry

💡 Especially helpful for businesses with lots of transactions or reimbursements.

⚡ 9. FreshBooks (Best for Service-Based Invoicing)

Freelancers and consultants love FreshBooks for its simple, clean interface and invoice-first design.

✅ Key features:

Easy time tracking + billing

Recurring invoices + client portals

Insightful dashboard with expense reports

💡 Not quite as comprehensive as QBO, but a solid option for solo service providers.

🧠 How to Choose the Best Financial Software for Your Business in 2025

Ask yourself:

Do I need basic bookkeeping or robust reporting?

Do I want to do it all myself or hire a bookkeeper?

Am I focused on saving money, saving time, or both?

Start small. Scale up. The beauty of financial software in 2025 is that you can mix and match based on your needs, budget, and goals.

💬 Final Thoughts: Make Your Money Tools Work for You

Choosing the best financial software for small businesses in 2025 is about more than just features: it’s about finding a tool (or toolkit) that makes your finances feel less overwhelming.

Whether you're a solo entrepreneur, creative professional, or growing small business, tools like QuickBooks Online, Relay, and Float can give you the clarity and control you need to grow with confidence.

And if all of this still feels a bit much? That’s what we’re here for.

📌 Need Help Setting Up Your Financial Software?

At Breakspears Bookkeeping Services, LLC, we help small business owners get started with the right tools, set them up properly, and actually understand the numbers behind their success.

👉 Explore our remote bookkeeping packages or book a free call today.

Bookkeepers vs CPAs: Who Should Handle Your Business Finances?

If you run a business, you’ve probably asked yourself this question:

“Who handles business finances? Should I hire a bookkeeper or a CPA?”

It’s a smart question - and one that trips up a lot of freelancers, side hustlers, and small business owners.

You’re not alone if you’re wondering:

“Aren’t they basically the same thing?”

“Do I need both?”

“Which one will actually help me save time and money?”

Let’s break it down simply: no accounting jargon, just straight answers - so you know who to call, when to call them, and why it matters.

If you run a business, you’ve probably asked yourself this question:

“Who handles business finances? Should I hire a bookkeeper or a CPA?”

It’s a smart question - and one that trips up a lot of freelancers, side hustlers, and small business owners.

You’re not alone if you’re wondering:

“Aren’t they basically the same thing?”

“Do I need both?”

“Which one will actually help me save time and money?”

Let’s break it down simply: no accounting jargon, just straight answers - so you know who to call, when to call them, and why it matters.

💼 What Does a Bookkeeper Do?

A bookkeeper is the person who helps you organize, track, and maintain your financial records on a regular basis.

They handle:

Recording income and expenses

Reconciling bank statements

Categorizing transactions

Managing accounts receivable and payable

Creating monthly financial reports (Profit & Loss, Balance Sheet, Cash Flow)

At Breakspears Bookkeeping Services LLC, we specialize in helping solo entrepreneurs, creative professionals, and small business owners stay on top of their numbers with flat-fee monthly bookkeeping—so you never feel overwhelmed or behind.

💡 Think of a bookkeeper as your financial sidekick, keeping your books tidy and your business running smoothly every single month.

📊 What Does a CPA Do?

A Certified Public Accountant (CPA) is a licensed professional who can:

File your business taxes

Offer tax planning advice

Help with audits or financial compliance

Create detailed financial forecasts

Provide strategic advisory for larger financial decisions

CPAs are most valuable at tax time or if your business structure is complex (e.g. multi-member LLCs, corporations, investors involved).

💡 Think of a CPA like a financial consultant—great for the big-picture strategy and tax-saving moves, but not someone you typically talk to every week.

🤔 Bookkeeper vs CPA: What’s the Difference?

📌 So... Who Handles Business Finances?

Here’s the golden rule:

➡️ Bookkeepers handle your daily and monthly finances.

➡️ CPAs step in for tax time and long-term planning.

Most businesses - especially freelancers, solopreneurs, and creative entrepreneurs need both at some point, but they don’t need them both all the time.

💡 A bookkeeper is your ongoing partner in staying organized, saving time, and being ready for taxes.

💡 A CPA is your seasonal expert who makes sure you’re compliant and tax-efficient.

🧠 Why Bookkeepers Are Often Your First and Most Frequent Hire

When you're just getting started or growing your business, it's your bookkeeper who:

Keeps your financial records clean and audit-proof

Makes tax time easy by preparing everything your CPA will need

Helps you understand your cash flow and profit month to month

Saves you from last-minute receipt hunts and spreadsheet chaos

That’s why so many small business owners trust Breakspears Bookkeeping Services, LLC to keep their finances on track with affordable remote bookkeeping packages.

👩💼 When Do You Need a CPA Instead of a Bookkeeper?

Call a CPA when:

You're filing complex taxes or have employees

You're applying for loans or outside investment

You're dealing with an IRS audit or notice

You’re changing your business structure

You want detailed tax planning strategies

In these cases, your bookkeeper and CPA can work together. Your bookkeeper provides clean, accurate records - and your CPA builds on that foundation for taxes or big decisions.

🔁 Bookkeeper + CPA = Your Dream Financial Team

You don’t have to choose one over the other.

You just need to know who does what and when to bring them in.

Think of it like this:

Your bookkeeper keeps the machine running smoothly.

Your CPA tunes it up when it’s time to race.

And when they work together? You get clarity, compliance, and confidence - without the financial overwhelm.

🎯 Final Thoughts: Who Should Handle Your Business Finances?

If you’re asking who handles business finances, bookkeeper vs CPA, the real answer is:

➡️ Start with a bookkeeper. Bring in a CPA when the time is right.

Most of your ongoing financial needs - like staying organized, tracking cash flow, and understanding your numbers can be handled by a great bookkeeper (🙋♀️ like me!).

At Breakspears Bookkeeping Services, LLC, we offer: